Thermal Product Solutions New Columbia PA TPS. Tamper Proof Screw various companies TPS.

And returning would put them at risk of violence disease or death.

Tps tax meaning. TPS Tax Abbreviation Meaning. Tax TPS abbreviation meaning defined here. What does TPS stand for in Tax.

Get the top TPS abbreviation related to Tax. The province of Quebec follows a provincial sales tax model rather than the HST model so there are two separate taxes to monitor. Here the GST is la taxe sur les produits et services or TPS while the provincial sales tax is la taxe de vente du Quebec or TVQ.

If your accounting software is already set up to refer to Canadian taxes such as the GST PST and HST it should be a relatively small tweak to. Tax Performance System Computed Measures. The Tax Performance System TPS Computed Measures are gathered from data that are electronically reported by each state to the US Department of Labor.

These measures provide information on the timeliness and completeness of state tax activity. They provide information on. Employer compliance with payment.

Temporary Protected Status TPS is granted by the Secretary of the Department of Homeland Security Secretary to eligible foreign-born individuals who are unable to return home safely due to conditions or circumstances preventing their country from adequately handling the return. TPS GST Goods and Services TAx TVQ PST Provincial Sales Tax FOB FOB Free on BoardFOB. Indicates which services come with a priceDescribes a price which includes goods plus the services of loading those goods onto some vehicle or vessel at a named location sometimes put in parentheses after the fob.

Theatre Puget Sound Seattle WA TPS. Taxe sur les Produits et Services. Toronto Police Service Toronto Canada TPS.

Tamper Proof Screw various companies TPS. Telekomunikacja Polska SA Polish. According to the statute it is any school which provides elementary education or secondary education kindergarten through grade 12 as determined under State law.

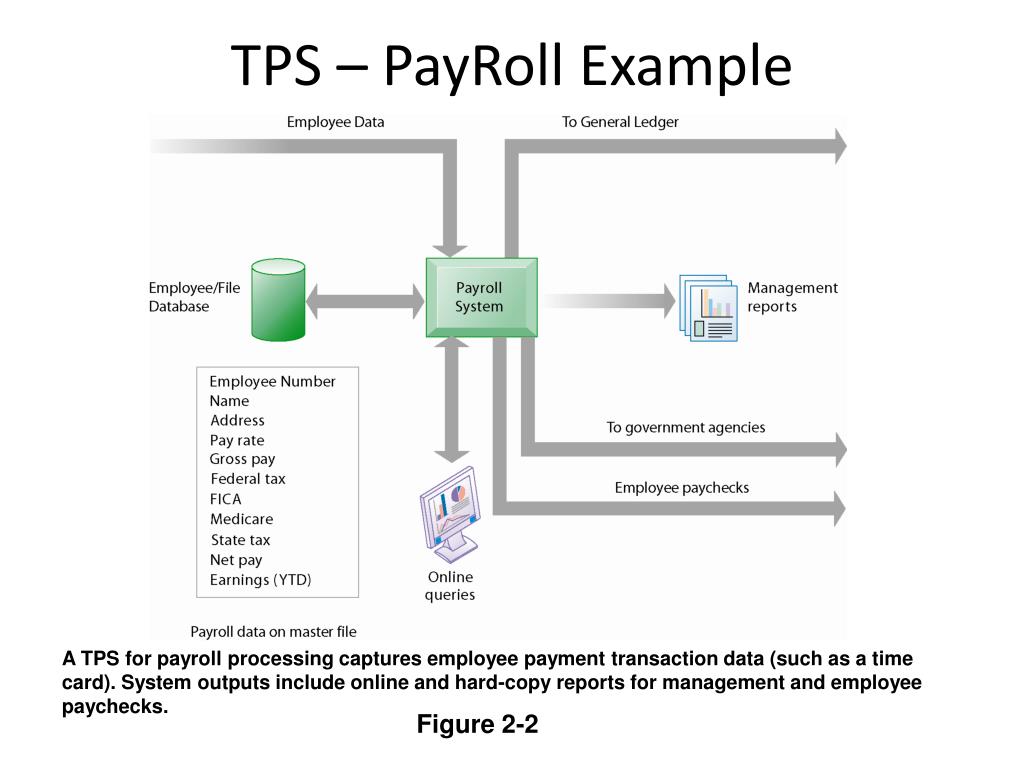

Whether TPS can be considered a school under this definition is a matter of interpretation and the laws of each state. A transaction process system TPS is an information processing system for business transactions involving the collection modification and retrieval of all transaction data. Characteristics of a TPS include performance reliability and consistency.

TPS is also known as transaction processing or real-time processing. Town Planning Scheme various locations TPS. Thermal Product Solutions New Columbia PA TPS.

Theatre Puget Sound Seattle WA TPS. Taxe sur les Produits et Services. The harmonized sales tax HST is a combination of federal and provincial taxes on goods and services in five Canadian provinces.

The HST tax rate is 15 in all participating provinces except. What is Temporary Protected Status TPS. Temporary Protected Status or TPS was established by Congress through the Immigration Act of 1990.

TPS is intended to protect foreign nationals in the US. From being returned to their home country if it became unsafe during the time they were in the US. And returning would put them at risk of violence disease or death.

What is TVH meaning in Tax. 1 meaning of TVH abbreviation related to Tax. Pour exclure les taxes récupérables tps et tvq.

To exclude recoverable taxes gst and qst Last Update. Payroll taxes are imposed on both employers and employees and fall into two categories. Taxes paid by the employer and deductions from an employees wages.

Payroll Withholding Federal income tax withholding is based on two factors. The amount of income a. Academic Science Electronics.

Regional Airport Codes. Business General Business. Business Companies Firms.

How is Tax Preparation Software abbreviated. TPS stands for Tax Preparation Software. TPS is defined as Tax Preparation Software very frequently.

Temporary Protected Status TPS is a temporary status given to eligible nationals of designated countries who are present in the United StatesThe status afforded to nationals from some countries affected by armed conflict or natural disaster allows persons to live and work in the United States for limited times. Currently persons from twelve countries Haiti El Salvador Syria Nepal. Keeping up with payroll tax rates accurately calculating liabilities and making timely payments can be time-consuming.

Paychex helps you ease your business tax burden. Our payroll tax services include automatic tax administration well calculate pay and file your payroll taxes with the appropriate agencies and we make. Applicable Tax Rate means the estimated highest aggregate marginal statutory US.

Federal state and local income franchise and branch profits tax rates determined taking into account the deductibility of state and local income taxes for federal income tax purposes and the creditability or deductibility of foreign income taxes for federal income tax purposes Tax Rate applicable to. All matters of tax policy and legislation relating to direct taxes and the Benami Transactions Prohibition Act 1988 andor the Prohibition of Benami Property Transactions Act 1988. Monitoring of tax avoidance devices suggesting legislative remedial action.

Cases or Classes of Cases which shall be considered by Member TPS System.