The Quebec Income Tax Salary Calculator is updated 202122 tax year. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax.

See how we can help improve your knowledge of Math Physics Tax Engineering and more.

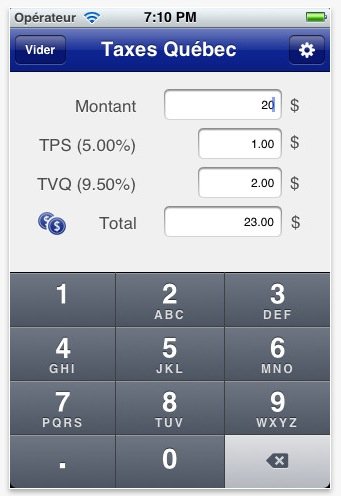

Calcul taxes qubec. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975. The QST was consolidated in 1994 and was initially set at 65 growing over the years to the current amount of 9975 set in 2013. GSTQST Calculator Before Tax Amount.

Reverse GSTQST Calculator After Tax Amount. Calcul taxes TPS et TVQ au Québec. Attention certains barsrestaurants font payer le pourboire sur le montant TTC alors quil devrait être calculé sur le montant HT.

Le TIP est au moins égal à la somme des taxes TPSTVQ soit 15. Cependant vous pouvez donner plus ou moins en fonction de la qualité du service reçu. Calculator to calculate sales taxes in Quebec Beware some bars restaurants charge a tip on the amount TTC while it should be calculated on the amount HT.

The TIP is at least equal to the sum of the taxes TPS TVQ is 15. Montant avant taxes x Taux de TPS100 Montant TPS. Montant hors taxes x Taux de TVQ100 Montant TVQ.

Montant hors taxes Montant TPS Montant TVQ Montant avec taxes. Cette formule est entrée en vigueur le 1er janvier 2013. Depuis cette date la TVQ nest plus comptabilisée sur le montant comprenant la TPS.

Calculation of inverted taxes for residents of Quebec in 2020 Amount with sales taxes - GST 5 - QST 9975 Amount without taxes Tax rate GST and QST for 2020. Income tax calculator takes into account the refundable federal tax abatement for Québec residents and all federal tax rates are reduced by 165. Quebec provincial income tax rates 2020.

In 2020 Quebec provincial income tax brackets and provincial base amount was increased by 19. Basic personal amount in Quebec for year 2020 is 15532. The Quebec Income Tax Salary Calculator is updated 202122 tax year.

Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax. Our Income Tax Calculator Quebec revenue will assist you with estimate your 2019 income tax obligation and give you an approximation of whether you can anticipate a discount this year.

This calculator considers the refundable federal tax reduction for Québec inhabitant and all federal tax rates are decreased by 165. Online calculator calculates Reverse Québec sales taxes - GST and QST 2020. Use our calculator to determine your tax or Reverse Quebecs cur.

Welcome to Calcul Taxes. In 2021 GST And QST Tax are same so you can use our 2020 tax calculator to calculate your tax. If canada mad any changes in the tax.

We will update in our website. Formula for calculating the GST and QST. Amount before sales tax x GST rate100 GST amount.

Amount without sales tax x QST rate100 QST amount. Amount without sales tax GST amount QST amount Total amount with sales taxes. Changes in Recent Quebec Sales Tax History.

The province of Quebec has changed the way of calculating its sales tax. Before 2013 the QST tax was calculated on the selling price plus GST. It is now calculated on the selling price only not including GST.

The Quebec Sales Tax increases to 9975 of the selling price to maintain. Welcome Tax also known as Taxe de Bienvenue or Land Transfer Tax is a tax paid by the buyer to the Quebec municipality in which heshe purchased Real Estate. Typically you must pay this Welcome Tax within 30 to 60 af ter notarizing.

Welcome Tax is calculated using the higher of the purchase price or the municipal evaluation. Income Tax Calculator Quebec 2020. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2020 income tax refund.

This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. This is very simple GST calculator for Québec province. This online calculator calculates both sales taxes Goods and Services Tax GST and Québec Sales Tax QST.

Québec province is using QST instead of PST. Any input field of this calculator can be used. Tax calculation is available for any Canadian Province.

Tax calculation is also available for Canadian Territories. You can now click Save to save current calculation. You can quickly access latest government news from all province finance ministry when available You can use your prefferred Canadian language.

We have a Grizzly Bear image. The tax amount is calculated as follows. No tax under 5000 05 for the first 50 000 10 between 50 000 and 250 000 15 for any amount exceeding 250 000.

You must use the 9975 rate to calculate the QST if your cash register calculates the GST and QST in two steps that is if it calculates 5 GST on the sale price then also calculates the QST on the sale price. This rate may be rounded off to 997 only if your cash register cannot process three-decimal numbers. Note that by registering your company for the GST it is automatically registered for the harmonious sales tax or HST.

This is a tax that applies at the rate of 15. If in your activities you plan to pay wages to employees you must register as an employer in the withholding tax file. Allocate tips to your employees if applicable.

Add your employees tips to their base wages to calculate their source deductions and employer contributions. You must also report tips on. The RL-1 slip you must file for each of your employees.

The Employers Statement of Tips and Tippable Sales that you must send us. 6000000 salary example for Quebec in 2021. The 2021 Quebec Tax Calculator provides free online tax calculations for Quebec province tax and Federal Tax tables in 2021.

One of a suite of free online calculators provided by the team at iCalculator. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Calculatrice TAXES TPS TVQ QUEBEC Calcul TPS TVQ Québec - 14975 La TPS taxe sur les produits et services et la TVQ taxe de vente du Québec sont des redevances du Canada.

Remplissez lun des champs ci-dessous les autres safficheront automatiquement. Most properties are assessed using a market value-based approach. You can calculate your property tax using either your homes assessed value or your homes most recent market price.

Just enter the price and type of your property and we will give you an instant property tax.