Only four Canadian provinces have PST Provincial Sales Tax. Aucune taxe ne doit être appliquée Calcul inversé de la TPS et TVQ Formule avec Excel.

Calcul taxes des résidentsentreprises du Québec à linternational.

Calcul taxes qc. Calcul taxes des résidentsentreprises du Québec à linternational. Aucune taxe ne doit être appliquée Calcul inversé de la TPS et TVQ Formule avec Excel. Vous avez un chiffre ex 100 en A6 sous Excel.

Vous désirez obtenir la TPS en B6 la TVQ en C6 et le total en D6. 7 rows Income Tax Calculator Quebec 2020. Use our Income tax calculator to quickly estimate your.

The Quebec income tax calculator is updated for the 2020 duty year. Personal Tax calculations and RRSP considering for 2020 with chronicled pay figures on average profit in Quebec for each market division and area. In the event that you are looking to calculate your income in Quebec you can choose a.

Calculating taxes for Quebec residents to other provinces of Canada in 2021. Regarding the sale of the book only the GST must be taken into account in this type of calculation. Calcul Conversion can not be held responsible for problems related to the use of the data or calculators provided on this website.

All content on this site is the. Tax rate GST and QST for 2020. GST rates are the same since 2008 at 5.

The QST rate is the same since 2013 at 9975. However the final rate remains the same since 2012 as the method of calculating QST has changed on January 1st 2013. QC Tax is an application to calculate easily TPS and TVQ taxes for all your purchases in Québec Canada.

The application also allows the reverse calculation of taxes. It is therefore possible to obtain the amount before taxes from the amount including taxes. - Calcul of the tip with the option to include or not taxes.

Simple tax calculator. Use the Simple tax calculator to work out the tax you owe on your taxable income for the full income year. This calculator will help you work out your tax refund or debt estimate.

It can be used for the 201516 to 202021 income years. 01 Jul 2021 QC 16693. The ATOs tax withheld calculator applies to payments made in the 202122 income year.

For information about other changes for the 202122 income year refer to Tax tables. If you employ working holiday makers other tax tables apply. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432That means that your net pay will be 40568 per year or 3381 per month.

Your average tax rate is 220 and your marginal tax rate is 353This marginal tax rate means that your immediate additional income will be taxed at this rate. This is income tax calculator for Québec province residents for year 2012-2020Quebec personal income tax rates are listed below and check this page for federal tax rates. This tax calculator is used for income tax estimationPlease use Intuit TurboTax if you want to fill your tax return and get tax rebate for previous year.

It is free for simple tax returns or gives you 10. The province of Quebec follows a provincial sales tax model rather than the HST model so there are two separate taxes to monitor. Here the GST is la taxe sur les produits et services or TPS while the provincial sales tax is la taxe de vente du Quebec or TVQ.

If your accounting software is already set up to refer to Canadian taxes such as the GST PST and HST it should be a relatively. The real estate transfer tax exists in Quebec since 1992. It is a tax applied to home buyers during the purchase of a property and is also known as taxe de bienvenue in French or welcome taxIt was the minister Jean Bienvenue who recommended its application.

Property tax in QC. Assessed value of a property. Other cities in QC.

Gatineau Property Tax Calculator 2021. WOWA Trusted and Transparent. City of Gatineau Flag.

The City of Gatineau is located along the Ottawa River and Gatineau River in the Outaouais Region and is home to over 276K residents. Gatineaus real estate market consists of. Get started for free.

These calculations are approximate and include the following non-refundable tax credits. The basic personal tax amount CPPQPP QPIP and EI premiums and the Canada employment amount. After-tax income is your total income net of federal tax provincial tax and payroll tax.

Rates are up to date as of June 22 2021. Individuals who work or receive other income such as pension income in the province of Quebec have to fill out a federal Form TD1 Personal Tax Credits Return and a provincial Form TP-10153-V Source Deductions Return. Individuals who incur expenses related to earning commissions have to fill out a federal Form TD1X Statement of Commission Income and Expenses.

The simulation tool calculates the life income and temporary income based on the information you enter. The income that your financial institution pays to you may be different if. The data used for the calculation is incorrect.

The terms of your contract. Only four Canadian provinces have PST Provincial Sales Tax. British Columbia Manitoba Québec and SaskatchewanIn Québec it is called QST Québec Sales Tax and in Manitoba it is RST Retail Sales Tax.

In New Brunswick Newfoundland and Labrador Nova Scotia Ontario and Prince Edward Island it is part of HST Harmonized Sales Tax. Northwest Territories Nunavut and Yukon have no. Please note that paying taxes to the Eastern Townships School Board does not mean you are automatically registered on the English language school board voters list.

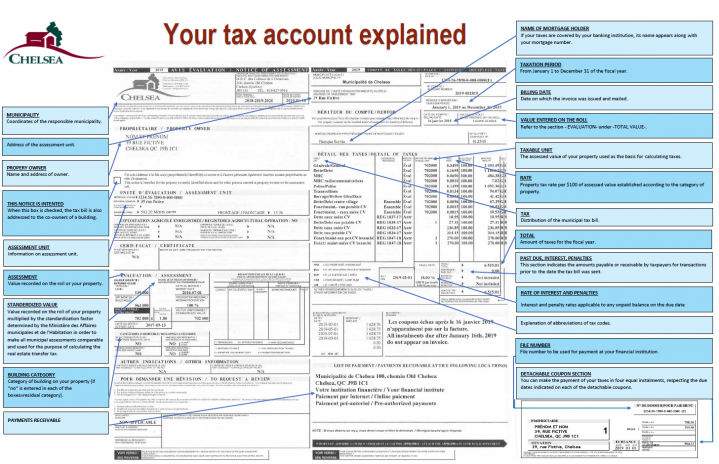

To check to see if you are on the list call the Director General of Elections for Québec at 1 888 ÉLECTION 1 888 353-2846. Ministère des finances Page daccueil. Explanation of the Tax Bill.

Do you have questions about your tax bill. You will find a model tax bill below along with a series of definitions to help you understand it. Tax bills are mailed to owners registered in the assessment roll at the beginning of January each year.

Sales tax calculator 2021 for Ontario. Ontariotaxcalculator is a simple efficient and easy to use tool in Ontario to calculate sales tax HST. Also is a tool for reverse sales tax calculation.

Sales taxes make up a significant portion of Ontarios budget. Revenues from sales taxes such as the HST and RST are expected to total 281 billion or 265 of all of Ontarios taxation revenue during the 2019 fiscal year. This is greater than revenue from Ontarios Corporation Tax Health Premium and Education Property Tax combined.

Do you want to know more about property taxes special taxes or borough taxes. Find out about your tax account tax deadlines and how tax bills can be paid.